PTS – Property Tax System

GIS Consortium aims to deliver a world of value to customers everywhere

GIS Consortium aims to deliver a world of value to customers everywhere

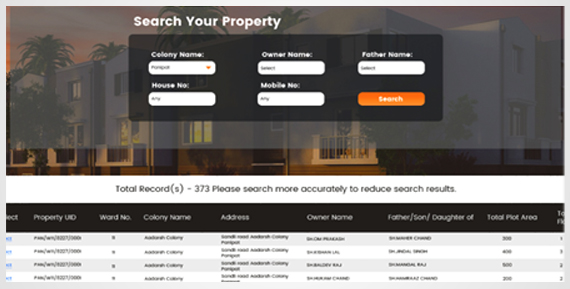

Property tax assessment is one of the areas of Municipal Corporation where we have introduced technology to meet the challenges of storing huge amount of data and updating it on a continuous basis in an effective manner. For example, a revenue inspector who has to collect property tax from a number of households would like to know the defaulters in his assigned area and an IT system can give him a document or spreadsheet listing the names and addresses of the same. However, if the inspector could be shown visualization on the map about where those properties are located, it would give him much more information than a spreadsheet.

Similarly, an administrative officer for a ward or zone could log into the GIS system and visualize the properties under his jurisdiction, and see the properties corresponding to the defaulters in different colors, depending on the amount to be paid by the defaulters.

The Property Taxation System (PTS) along with GIS is one such combination which attempts to benefit the municipal authorities for all queries related to property tax. Similar kinds of systems can exist for water tax management and any other tax-related information systems.

In India, many properties are not included in the tax base, while those that are included are often inaccurately assessed, leading to inefficient tax collection. Municipalities that have adopted our Property Taxation Systems have strengthened their revenues.